Retroactive Tax Credits 2024 Forms – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . The Tax Relief for American Families and Workers Act of 2024 advanced to the House Floor, which could mean big for companies due to a retroactive R&D credit provision. .

Retroactive Tax Credits 2024 Forms

Source : www.shrm.org

Joe Kristan on X: “Iowa extends PTET deadline for 2022 retroactive

Source : twitter.com

TaxSpeaker | Jeffersonville IN

Source : www.facebook.com

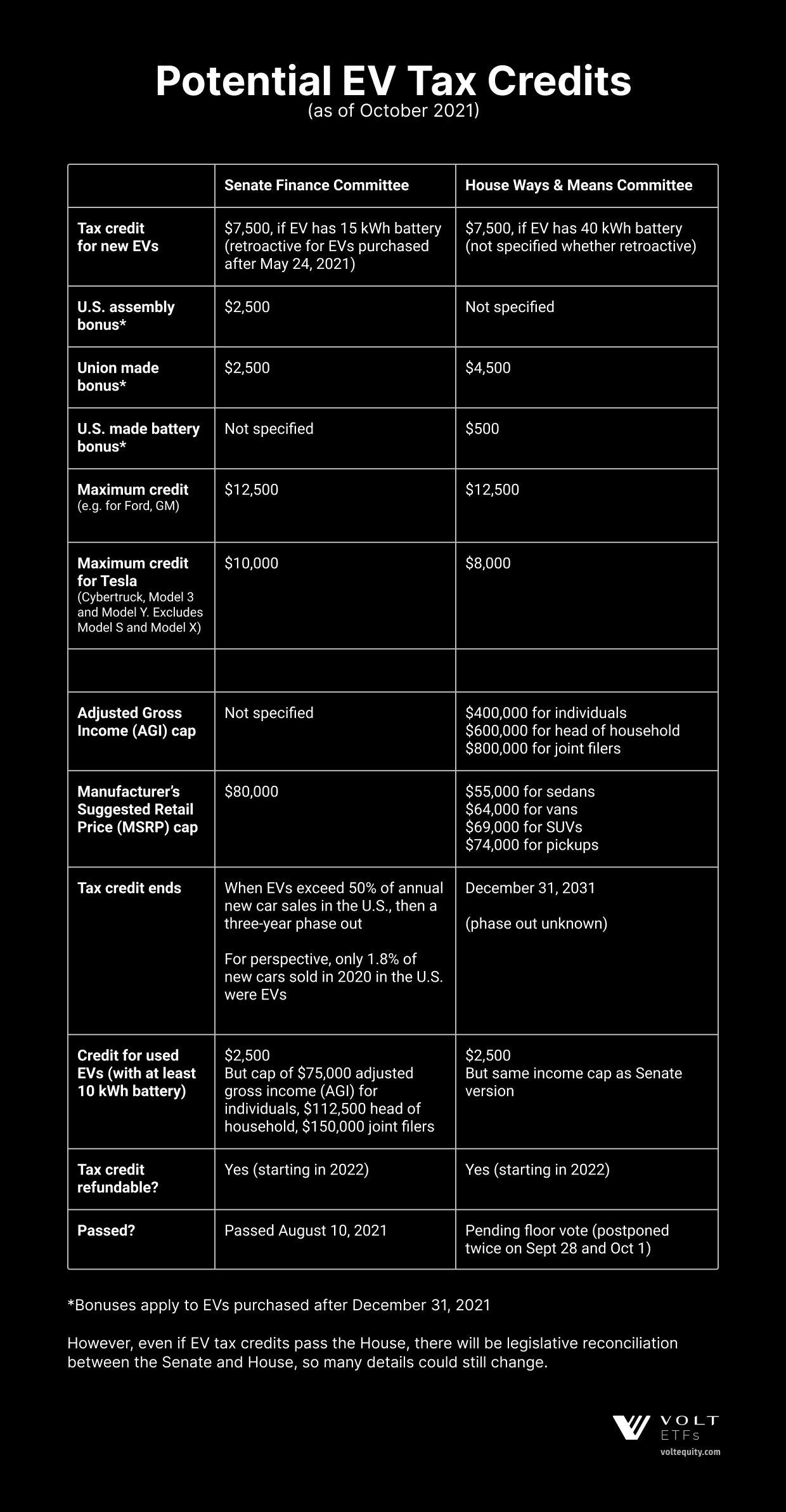

The Tesla EV Tax Credit

Source : www.voltequity.com

Taxes D.I.D Rite LLC | St. Clair Shores MI

Source : www.facebook.com

Federal Solar Tax Credit Guide For 2024 – Forbes Home

Source : www.forbes.com

Alameda County Social Services Agency

Source : www.facebook.com

Federal Solar Tax Credit 2024: What It Is & How Does It Work

Source : www.freshbooks.com

KG Tax & Consulting | Boynton Beach FL

Source : m.facebook.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

Retroactive Tax Credits 2024 Forms Retroactive Filing for Employee Retention Tax Credit Is Ongoing : Tax season always seems to start off with some kind of quirky, what-if component. This year, the what-if involves the possible expansion of the child tax credit, which likely would be retroactive . As you navigate the 2024 tax season, let our cheat sheet be your guide. The resources below provide expert advice on tricky tax topics and can help you start your return. .